The Magic is in

the Method

5 questions to simplify spending and clarify priorities

%20(1).avif)

The YNAB Method

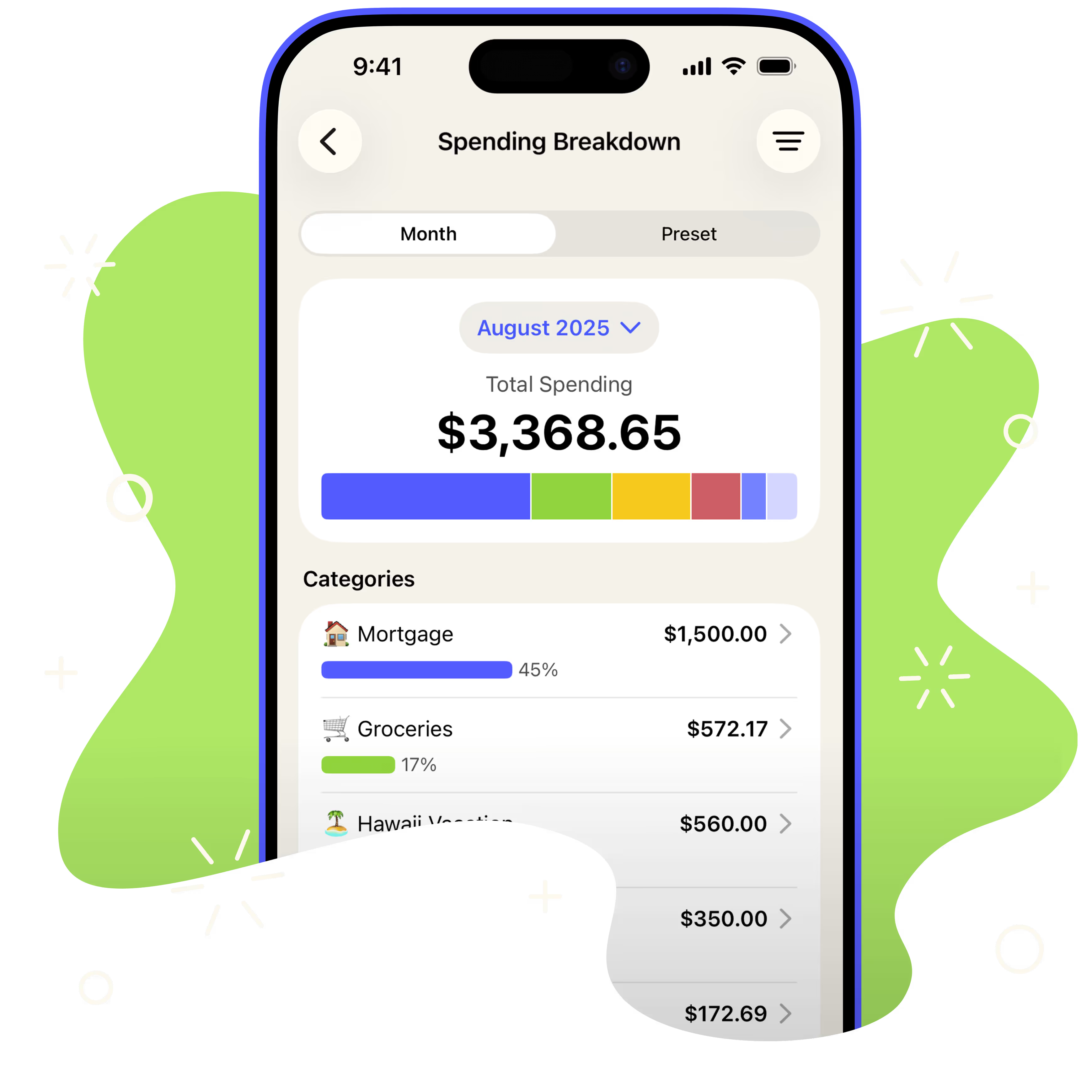

Give every dollar a job

The YNAB Method of giving every dollar a job is a proven process that aligns your money with what matters most to you. We call that spendfulness.

It’s pretty simple: You assign every dollar you have to one of your expense categories in YNAB based on what’s important and when it’s due. Then you check your plan prior to spending and make changes as needed along the way by moving money between categories.

.svg)

Putting the Method Into Practice

5 questions to give every dollar a job

Each of these questions has a different focus; you’ll move fluidly between them throughout your life as circumstances change, but spendfulness is available to you the moment you begin. You don’t set it as a distant goal and then arrive there later. You live it, in every moment, right now and always.

Reality

What does this money need to do before I’m paid again?

Assign every dollar you have to one of your expense categories to create a proactive plan for intentional spending.

stability

What larger, less frequent spending do I need to prepare for?

Non-monthly expenses like car repairs and holiday shopping are a fact of life. Break these down into manageable monthly chunks.

resilience

What can I set aside for next month’s spending?

With built-in breathing room, payday and due dates don’t matter and financial emergencies become minor inconveniences.

creation

What goals, large or small, do I want to prioritize?

Ask yourself what you really want out of life and then give your dollars jobs that will make that possible.

flexibility

What changes do I need to make, if any?

Flexibility means changing your plan when new priorities arise—without guilt, stress, or second-guessing.

Why giving every dollar a job works

Let’s break down each question and look at it in practice.

reality

Take care of what matters most.

What does this money need to do before I’m paid again?

You can’t plan a journey without knowing where you are. Getting clear about how much money you have and what that money needs to do next helps you avoid spending more important money on less important things.

.avif)

–Taylor

.avif)

– Kim

stability

Reduce stress and uncertainty.

What larger, less frequent spending do I need to prepare for?

Stability reduces stress and uncertainty. Anticipate upcoming expenses and start setting small, manageable amounts of money aside to save yourself from the emotional drama of one big bill. After all, the holidays happen every year and your car will need new tires someday—Future You will appreciate that you planned ahead!

resilience

Make life easier for Future You.

What can I set aside for next month’s spending?

Resilience is being proactive instead of reactive. When next month’s expenses are covered, payday and due dates don’t really matter and financial emergencies become minor inconveniences. This built-in breathing room helps you rest a little easier and frees up mental space for something more fun, like cheating at Monopoly.

.avif)

– Emily

.avif)

– Robert

creation

Build a life you’ll love to live.

What goals, large or small, do I want to prioritize?

Creation is giving your goals a chance (with money). Ask yourself the age-old question of, “What do I want to be when I grow up?” over and over again and then give your dollars jobs that will make that possible. Who do you want to be and how can the money you have help you get there?

flexibility

Change your plan (if you want).

What changes do I need to make, if any?

Flexibility means changing your plan when new priorities arise. There’s no such thing as a normal month and the answer to “Who do I want to be?” can change from at-home chef to DoorDash frequent-flyer on the drive home. And that’s okay! It’s your money and your plan for it can change at any time—without guilt, stress, or second-guessing. Change your mind, move some money, and move on.

.avif)

– Chris

Living spendfully

As you get into the habit of giving every dollar a job, you’ll create a state of alignment between the way you spend your money and the life you want to live. That’s spendfulness!

Spendfulness has benefits that are felt throughout your life, in areas that you never thought had anything to do with money—you’ll improve relationships, sleep easier at night, and feel more confidence, clarity, and joy each day. These results are both immediately accessible and continue to deepen over time, so there’s no time like the present to get started. Your future self will thank you!

.avif)

.svg)

.png)