How to Turn Your Budget into a To-Do List

I’m a productivity junkie—I’ve dabbled in most of the to-do list apps out there, and I’ve experimented with every variety of Post-it notes, pens, and fancy journals. Nothing ever seems to stick!

YNAB is great because I never have to “system hop” when it comes to my budget. Once it clicked for me, I was hooked, and I’ve never looked back. Having that framework for managing my finances is powerful and assuring, and I love that I don’t have to “hack” it to make it work.

How I use YNAB as a to-do list

Lately, part of my productivity experimentation involved YNAB. After all, I’m in my budget every. single. day. Sometimes (okay, most times) multiple times a day. Could there be a way to make it work for me as a to-do list? While I may forget to open my planner or accidentally toss that post-it note, there’s no doubt that my budget will always be there for me.

Here are some ways to use YNAB as a to-do list:

Scheduled transactions as reminders

The most obvious way to use YNAB as a to-do list is to take advantage of scheduled transactions. For example, thanks to YNAB, I know that my library card is due to expire in a few weeks. Unfortunately, the “cool” library (yes, there is such a thing) is just over the state border, and I have to pay $50/year to be able to check out a gazillion kids books every week.

It’s not on auto-renew, but seeing that transaction enter my budget is a reminder to do something about it. Do I want to renew my library card? Are there dusty, forgotten books that need to be returned (most likely)? It’s the nudge I need.

My teammates had all sorts of fun uses for scheduled transactions:

- Does a check need to be written for an expense, something that can’t be paid via auto-pay? Kat uses scheduled transactions to remind herself to do just that.

- Jen uses scheduled inflows to let her know she’s expecting reimbursement, while Ernie uses them to check incoming rebates (while we all lament that it would be better to receive in-store savings instead).

- Kelly uses scheduled transactions to remind herself to skip meal kit deliveries - something I am notoriously terrible at doing (although once, I requested to cancel and they refunded me, only to send the box anyway—which was great for my grocery budget).

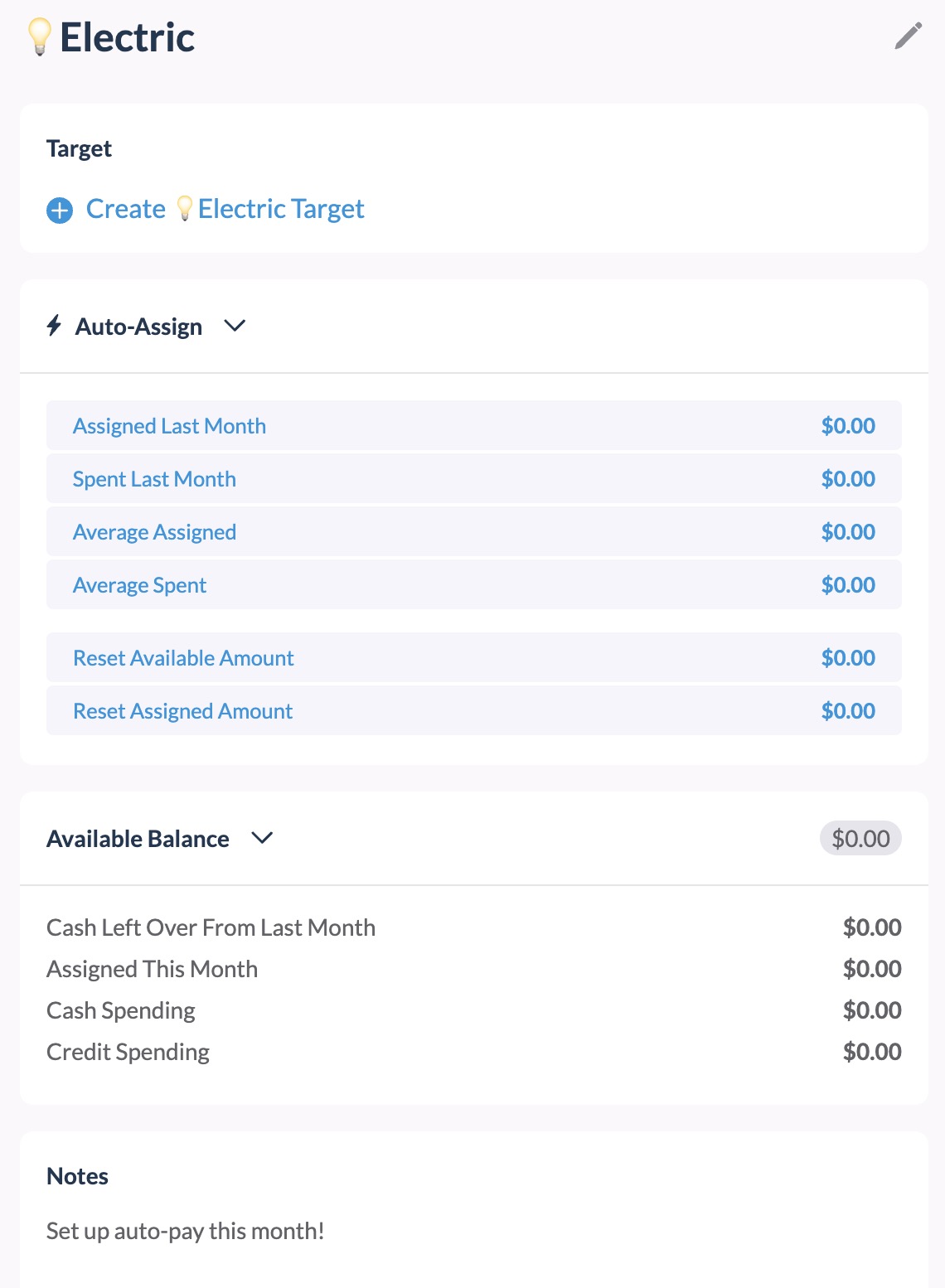

Use the notes field

The notes field is also extremely helpful—you can add month-specific to-do’s in the category header, or category specific notes in the—you guessed it—category. The “✅” emoji can be used to keep you on track.

Ashley G. uses her notes to keep track of birthdays and important events and to help manage her Christmas shopping, but her use of the “✅” emoji is downright genius! More on that below.

Use categories and category groups

Ashley uses a category group to organize all of her Christmas to-do’s, with each category representing something that needs to be purchased and completed, like buying stamps and sending out cards. Once it’s complete, the category gets the magic check mark (✅) and is moved to the bottom of the list.

Categories themselves can be standalone to-do’s, easily kept out of view by collapsing the category group. Once they’re completed, you can even delete them—YNAB will prompt you to choose a category to ‘merge’ them into, so your budget will be clutter free.

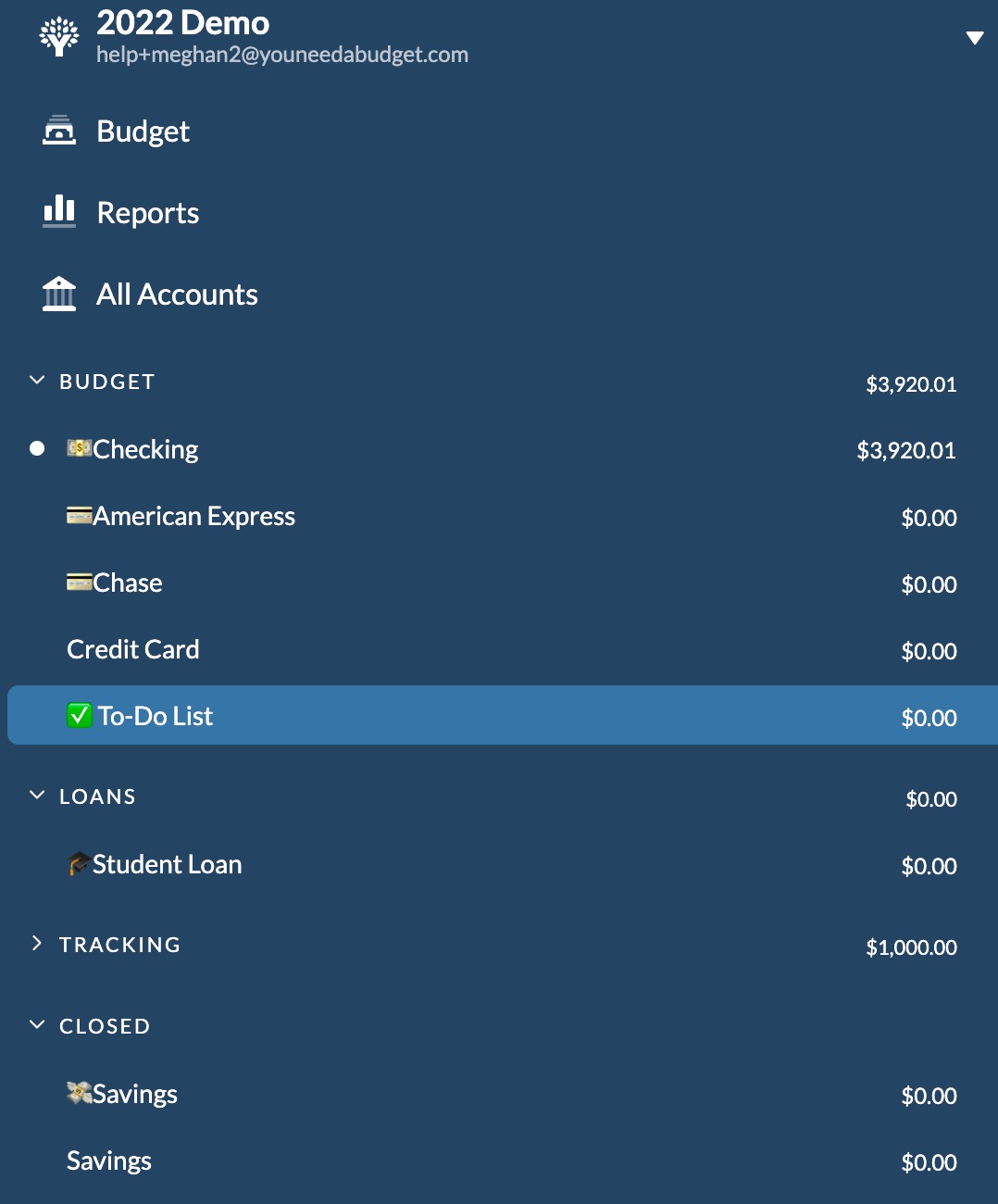

Create a to-do "account"

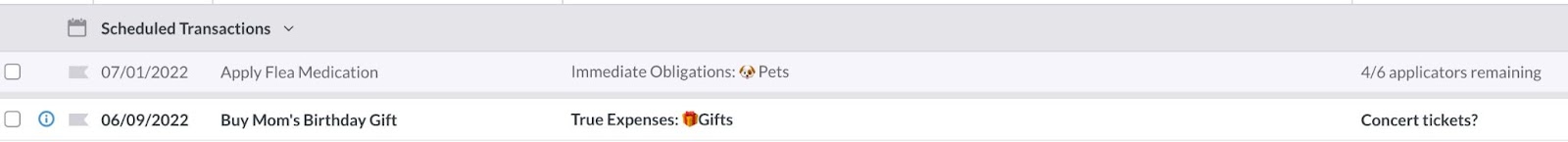

I created a specific account in my budget called “✅ To-Do List”. While it would be amazing if YNAB could import the contents of my running mental to-do list, this is the next best thing. In this account, I use scheduled transactions to create date-specific to-do’s: the date is when it’s due (repeating as necessary) and the ‘task’ is the payee. For the category, I’ll choose whichever is the most relevant.

For example, if my dog needs her flea medication, I’d choose the “Pet” category. If I need to buy a birthday present for my mom, I’d set it up like this, with “Buy Mom’s Present” as the payee, with “gifts” as the category:

I can use the memo field to keep track of any specific details, like ideas for her gift or even the URL of the item on Amazon. The beauty of this is that I don’t need to enter an amount for the “transaction”, but it’s preserved in my budget. Once the task is complete, I’ll “clear” it, so I still get that satisfaction of marking a check box. The cool part is that I can use the To-Do List account as a way to see everything that’s on my plate, and can filter by category as needed. And if I don’t want to see the completed to-do’s anymore? I can reconcile, and easily filter those out.

While I think I’ll forever experiment when it comes to my to-do list, using YNAB in this way has been a game-changer. It reduces the friction that comes from checking yet another app, website, or notepad, and makes it even more likely for me to interact with my budget. It’s a win win!

Interested in more budgeting tips and tricks? Join us on the Weekly Roundup, a fun, once-a-week email update on money matters!

.svg)

.png)

.webp)